Tel/WhatsAapp:+86 13366396425

E-mail: chloe_xia@vleap.com.cn

Garment bags look like “simple accessories” until you’re the person accountable for returns, odor complaints, mildew claims, wrinkled garments, damaged brand perception, and compliance documents. In B2B, the garment bag is not merely packaging; it’s a functional protective system that touches operations (warehouse picking, store backroom workflows), brand experience (premium unboxing, repeat use), and supply chain risk (humidity during sea freight, storage conditions in distribution centers).

The market often frames the decision as “PEVA vs cotton,” and that’s a useful starting point—because these two materials represent two distinct product philosophies. PEVA is typically chosen for its water resistance, wipe-clean behavior, and transparency (visibility). Cotton is typically chosen for breathability, softness, and premium hand-feel. This “headline difference” is also consistent with common industry explanations that describe PEVA garment bags as water-resistant and cotton garment bags as breathable and softer.

But for professional buyers—brand owners, sourcing managers, wholesalers, corporate program operators, uniform suppliers, and e-commerce sellers—the real question is deeper:

Which material best controls the risks that actually happen in your channel—and how do you specify it so a factory can reproduce it reliably at scale?

This long-form guide answers that question in an OEM/ODM sourcing context. It also shows how FYBagCustom approaches material engineering, custom development, QC, packaging, and channel-specific requirements (including Amazon FBA workflows), so B2B buyers can turn a “material debate” into a clean, executable production plan.

A large portion of sourcing failures happen because buyers say “garment bag” but mean different things. In B2B procurement, garment bags usually split into three families, each with a different performance KPI set.

Storage garment covers (closet protection) prioritize long-term garment health: breathability, dust protection, and reduced risk of odor/mildew. These are often used by bridal boutiques, premium fashion brands offering after-sale wardrobe care, uniform programs with seasonal rotation, or e-commerce brands bundling storage accessories. If the storage cycle is months, the buyer’s enemy is not rain—it’s trapped humidity. Sources that discuss garment bags note that lack of breathability (common in plastics and some non-wovens) can be problematic for garments in humid conditions, which is exactly the failure mode that shows up later as “smell” or mildew claims.

Retail/dry-clean transfer covers are operational tools. They optimize for visibility, cost, and quick protection from dust or light contamination from store to customer. The bag is touched frequently, and it must survive hanger-hole stress and quick handling. Transparency can materially reduce picking errors and staff time, which is why clear or translucent solutions are so common in this segment.

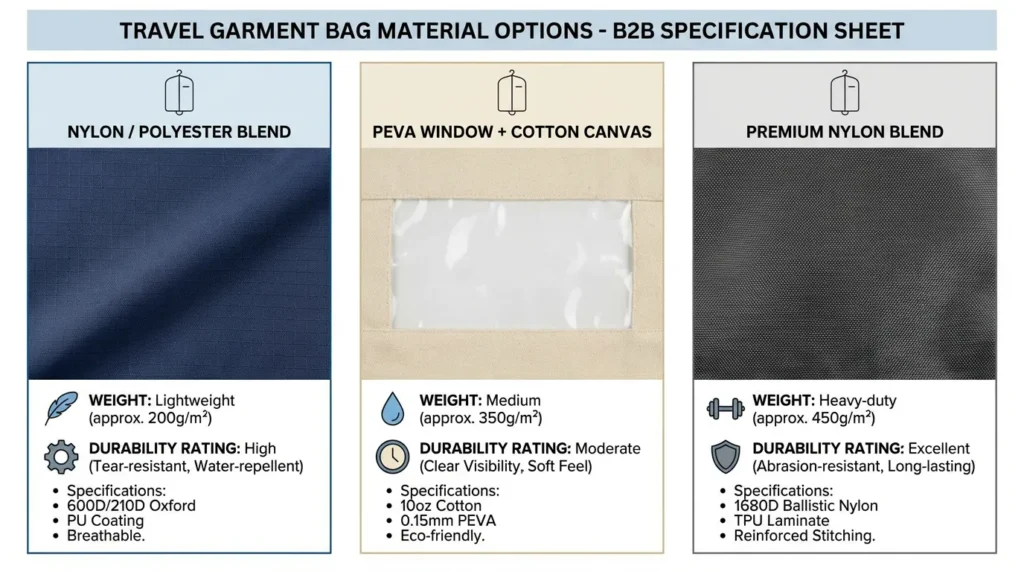

Travel garment bags (folding, tri-fold, carry-on style) are closer to luggage products: abrasion resistance, seam strength, hardware reliability, and structural control to minimize wrinkles. Many travel garment bags use nylon/polyester shells, but PEVA windows and cotton dust pouches can appear as sub-components or bundled accessories. Industry material breakdowns commonly place PEVA/PVC in the “transparent for quick ID” bucket and cotton canvas in “premium/boutique” positioning, while nylon/polyester dominate travel strength needs.

If you don’t specify which family you’re sourcing, suppliers will quote the cheapest “generic garment cover,” and your project will absorb the mismatch as returns or brand damage. So before you ask “PEVA or cotton,” lock these variables:

When these are clear, “PEVA vs cotton” becomes a structured decision instead of a guess.

Most buyers first encounter PEVA through “clear bags,” table covers, or shower curtain liners. In many consumer and trade contexts, PEVA is described as polyethylene vinyl acetate, often positioned as a PVC alternative and sometimes described as chlorine-free.

In garment bags specifically, PEVA is frequently used because it behaves like an operational material: it is typically water/moisture-resistant, lightweight, transparent or translucent, and easy to wipe clean, and these properties are explicitly listed as common advantages in industry guides comparing PEVA to cotton garment bags.

That said, in B2B we care less about “marketing definition” and more about what PEVA enables in your business model.

Transparency sounds trivial until you operate at scale. If a store backroom handles hundreds of garments per day, or a uniform distribution program manages thousands of pieces, each “open the bag to confirm” action multiplies into hours of labor and higher picking error rates. Clear PEVA removes that friction: staff can visually confirm garment type, color, or style without breaking the closure. This is why retail suit covers and showroom garment covers often lean toward clear PEVA or clear window panels, and why industry checklists for retail display covers highlight clear-window thickness specs and reinforced hanger openings—because these are operational stress points.

The procurement insight here is important: when visibility is your KPI, PEVA isn’t a material choice—it’s a workflow design choice. You are buying labor efficiency, not just plastic film.

Cotton looks and feels premium, but it behaves like a textile: it absorbs and holds moisture and stains. In channels where garment bags are handled by staff, moved across floors, loaded into vehicles, and used repeatedly, you need a surface that can be restored quickly. PEVA is commonly described as water/moisture-resistant and easy to wipe down.

That maintenance model changes the economics. If your program expects bags to be reused in-store, or you’re shipping garments that may encounter light exposure to rain or spills during last-mile movement, the ability to wipe clean reduces the number of bags that get “discarded early” due to appearance. In other words, PEVA can protect not only garments but also your internal reusability assumption.

PEVA covers are frequently perceived as “cheap,” and in a luxury branding context they can look utilitarian. But cost in B2B should be understood as total cost of ownership, not unit price.

PEVA’s lower cost (in many common builds) comes from being a film material with efficient cutting and simple construction, especially when the bag is designed as a straightforward hanging cover. That’s why high-volume retail and promotional garment covers often incorporate clear PEVA or other cost-efficient constructions.

However, “PEVA is cheap” becomes a procurement trap when buyers don’t control the details that determine whether the bag survives real use. If you specify only “PEVA garment bag” without thickness tolerance, reinforcement design, and zipper grade, you can end up buying a product that fails at stress points, generating replacements that erase any unit cost advantage. PEVA is cost-efficient when engineered correctly; when engineered poorly, it’s a false economy.

In B2B, PEVA’s weakness is not “it’s plastic.” Its weakness is that it is not naturally breathable like cotton, a point emphasized in common garment bag comparisons.

This matters most when the storage cycle is long and humidity is uncertain.

Garments are not inert. Wool, silk, and many blended fabrics retain small amounts of moisture; garments may be stored after steaming or ironing; customers may hang clothes in closets with fluctuating humidity. If you seal a garment inside a low-breathability environment, you can trap moisture. Over weeks or months, trapped moisture becomes a microclimate that encourages odor, mustiness, or even mildew growth—especially if the garment enters the bag slightly damp.

The key procurement lesson: the longer the storage cycle, the more “air exchange” becomes a quality feature. For long-term storage, breathability is not a luxury; it is a risk-control mechanism.

Many comparisons note that PEVA can be more susceptible to tearing or puncturing than cotton, depending on handling and construction.

This is most common at the hanger slot and top corners, where repeated load and friction concentrates stress. If a factory uses insufficient reinforcement or poor seam methods, the bag fails exactly where it must perform most.

So “PEVA durability” is less about the word PEVA and more about whether your supplier engineered:

Those details are the difference between an operationally reliable PEVA cover and a disposable one.

Cotton garment bags—canvas or muslin—tend to be chosen when the bag is expected to behave like a reusable protective accessory and not just temporary packaging. Many comparisons describe cotton as breathable and soft, which aligns with why it’s favored in higher-end storage and branding contexts.

For long-term closet storage, cotton’s natural air exchange helps garments “stay dry and fresh,” and this breathability advantage is explicitly stated in common PEVA vs cotton garment bag discussions.

This makes cotton particularly attractive for:

The buyer’s mindset should be: cotton reduces long-term complaint probability. When a customer opens a garment bag months later, a neutral smell and clean garment condition protect your brand reputation far more than a few cents saved on materials.

If your positioning is premium, packaging becomes a product. Cotton (especially canvas) feels tactile, textile-like, and “kept” rather than thrown away. That creates two compounding benefits:

FYBagCustom’s material engineering perspective emphasizes that fabric drives not only performance but also brand positioning and handfeel—exactly the logic that makes cotton garment bags valuable beyond pure function.

The same PEVA vs cotton comparisons that praise cotton breathability also note cotton’s disadvantage: it absorbs moisture easily and may require more care to prevent mold/mildew or stains.

For B2B, this translates into a supply chain requirement: cotton projects demand humidity management, especially for sea freight or warehousing in warm, humid regions.

In other words, cotton garment bags are not “automatically safer.” They are safer if your production and shipping system prevents damp packing conditions. If you ship cotton covers across ocean routes without a moisture strategy, you can end up with mildew spots on the bag itself—turning a premium packaging choice into a brand-damaging event.

A simple comparison is helpful, but only as a map. The real work is matching the map to your channel KPI.

| Dimension | PEVA garment bag | Cotton garment bag |

|---|---|---|

| Visibility for picking & operations | Strong (clear/translucent) | Weak unless window added |

| Water / splash resistance | Strong | Weak–medium (absorbs) |

| Breathability for long-term storage | Weak (limited breathability) | Strong (breathable) |

| Brand hand-feel / premium perception | Utility-oriented | Strong premium signal |

| Typical failure mode | tear/puncture + long-term odor risk | mildew/stain risk if logistics unmanaged |

This table doesn’t decide for you, because your project isn’t “a garment bag.” It’s a garment bag deployed inside a specific business system. The next sections translate this into channel-specific recommendations and then into factory-ready specifications.

In dry cleaner and retail transfer scenarios, the garment bag behaves like a short-cycle protective layer. Staff need to identify garments quickly, keep them clean, and hand them to customers without fuss. PEVA’s transparency and easy cleaning directly serve those needs, and retail cover guidance commonly notes clear PEVA as a standard option for visibility.

What many buyers underestimate is that failure here is usually structural, not conceptual. Hanger slot tearing and zipper failures create immediate operational friction. So the “right PEVA bag” is not just PEVA; it’s a PEVA cover with engineered stress point reinforcement and reliable closures.

If you’re sourcing for this channel, your RFQ should treat reinforcement and zipper spec as core performance features—because they protect your operational efficiency KPI.

Bridal and formalwear customers store garments longer, and the garments are often delicate and light-colored. That means two things: odor and mildew complaints become highly emotional, and discoloration risk feels catastrophic. Cotton’s breathability advantage makes it a common choice for muslin garment bags used for long-term storage.

But cotton’s absorption downside means your supply chain must be designed for dryness. Buyers in this segment should evaluate not only the bag material but also the factory’s packaging and pre-shipment controls—because the bag’s biggest risk may happen before it reaches the customer.

FYBagCustom positions packaging as part of brand experience and logistics risk control, offering end-to-end custom packing solutions including dust bags and export-ready practices—this matters directly for cotton garment bag programs.

For premium brands, a garment bag is part of the customer’s ownership experience. Cotton canvas can elevate perceived value and align with “natural material” storytelling. But premium doesn’t mean “expensive build everywhere.” The smartest premium sourcing is controlled: choose cotton where hand-feel matters, simplify construction where the customer doesn’t notice, and invest in branding methods that look expensive (embroidery, woven labels, clean screen prints) without overcomplicating the BOM.

FYBagCustom’s fabric system framing—fabric drives performance ceiling, brand positioning, and cost structure—fits this approach: you design the material system to match a portfolio (hero SKU vs core SKU), not just one item.

Uniform and corporate programs sit between retail transfer and long-term storage. If garments rotate weekly, PEVA may work—especially when visibility matters and storage rooms are controlled. If garments are stored seasonally, cotton becomes safer for long-term freshness. Many programs ultimately land on a hybrid strategy: a textile body (breathability + premium feel) with a PEVA ID window (operational efficiency). The buyer should treat hybrid as a first-class option, not a compromise.

If your garment bag is a sellable SKU or a bundle component, FBA requirements and review risk become procurement drivers. Packaging must support labeling, barcodes, and safe delivery. FYBagCustom specifically describes FBA labeling support (including FNSKU labels) and inspection services aimed at minimizing negative reviews, which is highly relevant if garment bags are shipped as consumer products through Amazon.

For e-commerce, the decision isn’t “PEVA vs cotton.” It’s “how do we prevent the most common review triggers?” Those triggers often include smell (for sealed plastics), mildew spots (for textiles shipped damp), and zipper failure. Your supplier choice should be judged on their ability to control these failure modes, not just material availability.

Most RFQs fail because they specify a name instead of a performance system. Here is how professional buyers translate “PEVA” into controllable parameters.

PEVA film thickness influences tear resistance, perceived quality, and even how the bag hangs. Thinner films feel cheaper and fail faster at stress points, but overly thick films can feel stiff, fold poorly, or increase cost unnecessarily. Retail cover checklists sometimes cite clear window thickness ranges (e.g., 0.2–0.3 mm) as typical engineering guidance for visibility panels.

You don’t need to adopt a single “standard thickness,” but you should specify:

PEVA’s mechanical weakness is concentrated at hanger openings, corners, zipper endpoints, and any handle area. Many PEVA vs cotton comparisons explicitly mention PEVA’s susceptibility to tearing/puncture under rough use.

This means your RFQ must treat reinforcement as part of the base spec, not an optional upgrade. The most common “factory shortcuts” that cause failure are: minimal reinforcement patches, weak binding, and insufficient stitch density around the hanger slot.

A factory-level RFQ should clearly describe:

In garment bags, zippers are the #1 place where consumers form an immediate quality impression. A PEVA cover can feel acceptable until a zipper sticks or breaks. Buyers should specify zipper gauge (#3, #5, etc.), slider type (auto-lock vs standard), and puller requirements. FYBagCustom’s custom design documentation explicitly lists zipper sizes and customization options in its broader bag development framework, which signals that zipper specs are treated as formal engineering parameters, not casual choices.

Cotton garment bags appear simple, but “cotton” hides a wide range of fabrics—muslin vs canvas, different weaves, different weights. If you don’t specify fabric weight, you can get inconsistent hand-feel and cost surprises.

GSM (grams per square meter) is a standard measure of fabric weight. Industry references explain GSM as the grams of a 1m x 1m fabric piece, and that higher GSM generally means heavier/thicker fabric.

For cotton garment bags, GSM influences:

Your RFQ should specify a target GSM and tolerance. Without it, you’re not buying “cotton garment bags”; you’re buying the supplier’s default cotton—whatever it is that week.

Canvas is often used when you want structure and a premium look, while muslin is used when breathability and softness are key. Material guides for garment bags commonly position cotton canvas as upscale and breathable, often preferred by boutiques.

Finishes are where cotton projects can accidentally create compliance risk. Water-repellent or anti-mildew finishes can be useful, but they must match your target market compliance expectations. FYBagCustom’s material and treatment framework discusses performance treatments such as water-repellent and other finishes within an OEM/ODM design process, indicating that treatments are selectable engineering levers—not generic claims.

Cotton absorbs moisture; comparisons explicitly list moisture absorption as a cotton disadvantage.

That means your program must set packaging and shipping requirements, especially for sea freight:

FYBagCustom’s packing philosophy frames packaging as “protect & preserve” and “compliance & efficiency,” and it lists capabilities like dust bags, labeling, and export-ready cartons—these are the practical tools you need to manage cotton’s logistics risks.

PEVA is often marketed as a PVC alternative, sometimes described as chlorine-free and associated with lower VOC narratives in consumer contexts.

But B2B compliance must be documented, not inferred from marketing names.

If you sell into the EU, certain phthalates are restricted in plasticised materials in consumer articles above specified thresholds; EU legal text and industry summaries describe a 0.1% combined concentration threshold for certain phthalates in plasticised materials for consumer articles (with timelines and scope details).

Your compliance approach should be: define your target market, then request appropriate declarations and test reports from suppliers.

FYBagCustom’s QC page states that products meet global compliance requirements (REACH, RoHS, CPSIA), and that test reports/certifications can be provided upon request, with openness to third-party inspections such as SGS/BV.

For B2B buyers, this kind of posture matters because it indicates the supplier is structurally prepared for documentation workflows.

Cotton is renewable and biodegradable, but environmental impact depends on farming and supply chain. WWF notes that runoff of pesticides, fertilizers, and minerals from cotton fields can contaminate water bodies, highlighting a key sustainability risk of conventional cotton systems.

So if your brand wants to market “eco,” you should specify what you mean:

FYBagCustom’s design and packaging pages mention recycled materials and eco-forward packaging options (including recyclable/biodegradable and FSC-certified packaging), which can support ESG-oriented programs when paired with the right documentation.

Garment bags are deceptively simple. That’s why they often receive “light” QC attention—until a batch fails in the market. Professional sourcing treats garment bags like any other functional bag product: the failure modes are predictable, and the solution is systematic QC planning.

PEVA covers should be inspected for:

Even if you don’t run a formal lab test program, these checks catch most market-facing failures.

Cotton covers should be checked for:

FYBagCustom’s QC framework describes material inspection, in-process control, finished product testing, and packaging/pre-shipment checks as a structured system, along with AQL-trained inspectors and detailed QC reports.

For B2B buyers, this is not marketing fluff; it’s the supplier-side infrastructure that prevents the three most expensive outcomes: rework, delayed shipments, and customer-facing defects.

Garment bags often start as “copy this sample,” but scalable OEM/ODM requires documentation and pre-production locking.

FYBagCustom’s custom design workflow outlines a structured path: brief & feasibility, spec sheets and 3D mockups, sample development, PP sample + QC plan (including AQL and tests like colorfastness, pull tests, load tests, carton drop tests), then mass production and packing (including branded packing and FNSKU/barcodes).

The buyer-side takeaway is straightforward: to keep garment bag projects stable across seasons and reorders, insist on:

This reduces “supplier dependence on memory” and protects you when you scale, reorder, or expand colorways.

In many B2B programs, the best answer is neither “all PEVA” nor “all cotton.” It’s a hybrid that combines:

Retail garment cover trends commonly describe combining visible fronts with more premium-looking backs, and mention clear panels and reinforced openings as standard engineering moves.

Hybrid builds also help you avoid the two worst-case failures:

If your program spans both “store operations” and “customer long-term use,” hybrid should be considered the default architecture.

Below is a template that forces comparable quotes because it turns “material names” into production parameters.

Product family: storage cover / retail transfer cover / travel garment bag

Use duration: ___ days / ___ months

Target market: US / EU / UK / AU / other

Order quantity: ___ pcs (color split: ___)

Dimensions: L ___ × W ___ × Gusset ___ (cm)

Hanger opening: shape ___ + reinforcement ___

Closure: zipper (gauge #__ , slider type ___) / velcro / drawstring

Handles: none / top / side; expected load ___ kg

Option 1: PEVA

Option 2: Cotton

Option 3: Hybrid

Branding: screen print / embroidery / woven label / rubber patch (placement ___)

Packaging: individual bag ___; carton spec ___

If Amazon: FNSKU labeling / carton marking requirements ___

Inspection: AQL level ___; third-party inspection allowed (SGS/BV) yes/no

Garment bags sit at the intersection of material performance and brand experience. FYBagCustom’s positioning is built around that intersection: an engineering-first fabric system, structured custom design workflow, QC infrastructure, and packaging ecosystem designed for global B2B delivery.

If your project needs:

…then the supplier choice should prioritize “system capability,” not just “can they make it.”

Choose PEVA when your KPI is visibility + wipe-clean + operational speed, and the storage cycle is short.

Choose cotton when your KPI is long-term garment health + premium hand-feel, and you can manage humidity in production/shipping.

Choose a hybrid when you need both—and most serious B2B programs eventually do.